R.I.P. Quibi

April 2020 – December 2020

“I attribute everything that has gone wrong to coronavirus.”

— Jeffrey Katzenberg, New York Times 5/11/20

The (Very Fast) Rise and Fall of 2020's Greatest Unicorn

The fleeting unicorn fairytale of Quibi captured our attention right from the beginning. Billed as ‘Big Stories, Big Screen’, Quibi was poised to take the entertainment industry by storm in 2020. Established on the premise that humans have a short attention span, and an insatiable desire to consume content – Quibi (short for Quick Bites) set about building a model that would cater to the time-poor Gen Z’ers who are avid consumers of short-form video content, take their lead from social influencers, and like to be entertained. The value proposition was to deliver 10-minute chapters of superior-quality content formatted to fit on a smartphone screen. What could go wrong?

Celebrity Founders

Button

Big Names | Big Bucks

Write your caption hereButton

Big Names | Big Bucks

The brainchild of the hugely successful Jeffrey Katzenberg, co-founder of DreamWorks, coupled with former eBay and Hewlett Packard boss Meg Whitman as chief executive, Quibi was the darling child of Hollywood afficionados and Silicon Valley tech giants – a match made in start-up heaven.

The duo’s reputations and confidence attracted more than $1.7 billion from investors including Disney, 21st Century Fox, NBCUniversal, Sony Pictures, Viacom, and Alibaba, many of whom were already developing their own streaming services. “What Google is to search, Quibi will be to short-form video” Katzenberg boasted. Yet, less than 6 months after the launch, Quibi shut its doors, pledging to return whatever cash was left to its investors.

So, what happened? In May 2020, only one month after launch, Katzenberg told the New York Times that the pandemic was to blame for “everything that had gone wrong”. In contrast, streaming across other major platforms soared as people sought stay-at-home entertainment.

Months later, with the benefit of reflection, Katzenberg told CNBC that they got the product market fit wrong.

Who was the customer?

Looking at emerging trends, Quibi's leadership may have perceived a glaring gap in the market. We were consuming more content on the go than ever before, we have grown intolerant to being bored, and the explosive growth in mobile devices guaranteed enormous reach to mobile-first products. The way we consume content has shifted from infrequent, synchronous, blockbuster viewing habits to frequent, asynchronous, bitesize viewing habits. The big screen experience is dying out, giving way to social media feeds and on-demand streaming services. How users consume content has also shifted to multi-screen formats with content being consumed on laptops, tablets and phones.

Short-form content, in particular, was growing exponentially across platforms like Instagram, YouTube and TikTok. Taking all of these trends together, it's easy to assume that consumers would grow restless with low-budget low-quality content and demand a better experience.

The big question is - was anyone willing to pay for it?

What Was the Customer Job-To-Be-Done

The Quibi job statement is pretty clear from their early interviews and statements – they had established their niche (customers on the go) and their customer persona (25-35 year olds with phones). What was the job this customer persona needed to get done that Quibi could help them do better or cheaper?

We're guessing the analysis went a little like this:

| Demand | Gen Z likes videos, entertainment, celebrity, independence, is mobile-first, and has a short attention span. They consume content on-the-go |

|---|---|

| Supply | The market has long form, high quality original content (Netflix and cinema, Apple TV, Amazon), and low-quality user-generated content (YouTube, TikTok, Instagram, Snapchat). |

| Market Gap | GenZ doesn’t have access to high-quality original content on-the-go between the hours of 7am-7pm. |

If we look at the product offering through this lense, it seems Quibi was prepared to go head-to-head with the entire market. But, wait – consumers use YouTube, TikTok and Instagram for free - did Quibi overlook the Power of Free?

Well, seemingly not. Katzenberg told the Verge in January 2020 “We’re competing against free… [but]… we have to offer something that is meaningfully, measurably, quantifiably, creatively different." Ah ... OK, so they intend to capture a different segment of the market - charge more and do it better?

In January 2020, 67 days before launch, CEO Meg Whitman was quoted as saying “Quibi won’t compete with Netflix, Hulu, or Disney Plus”, mainly because Quibi was taking a mobile-first approach. Quibi’s gamble was to straddle the intersection of the market by producing premium short-form content for consumption on-the-go.

Using the Jobs-to-be-Done framewor, a customer JTBD statement might look like this:

When [commuters between the ages of 25-35] need to [alleviate boredom] in a situation where [they have access to their smartphone] they struggle to [find premium entertainment content]

Assuming this is a genuine job a consumer is trying to get done, leet's take a brief look at what other tools customersare currently using to get this job done, and why they might switch

| Tools Users Have Hired To Get The Job Done | Reasons For Hire | Barriers To Hire |

|---|---|---|

| YouTube | Amusement, Influencer Demos, Vlogs | Too many ads, Overwhelm |

| TikTok | Amusement, Catch Up | Overwhelm |

| Catch up with friends | Unwanted ads, Privacy concerns | |

| Catch up on relevant content | Too much choice, Overwhelm | |

| Catch up with friends, communicate | Privacy concerns | |

| Catch up, Shopping, | None | |

| Medium | Learn | Limited freemium offer |

| Audible | Learn | Paid service |

| EdX | Learn | Effortful |

| News, Catch Up | Overwhelm | |

| Spotify | Listen to music | Limited freemium offer |

| Headspace | Mindfulness | Limited freemium offer |

| Webinars | Information | Effortful |

| Check email,... and so on | Productivity | None |

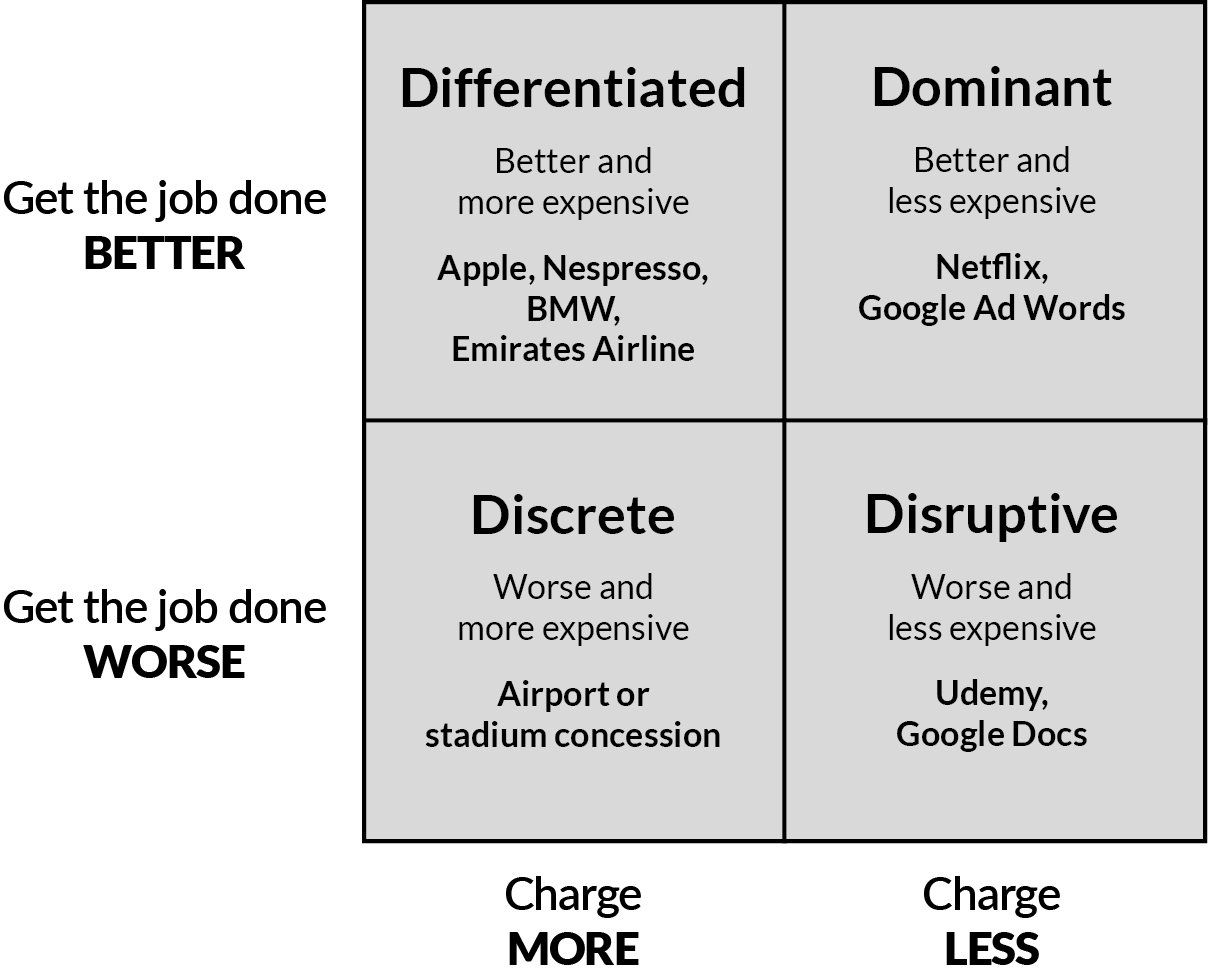

Quibi’s positioning was to do the job better and charge more - engaging a Differentiated growth strategy.

A company pursues a differentiated strategy when it discovers and targets a population of underserved consumers with a new product or service offering that gets a job (or multiple jobs) done significantly better, but at a significantly higher price.

Examples of offerings that successfully employ a differentiated strategy include Nest’s thermostat, Nespresso’s coffee and espresso machines, Apple’s iPhone 2G, Whole Foods’ organic food products, Emirates airlines’ international flights, Bang & Olufsen’s personal audio products, BMW sports cars, Sony’s PlayStation (original model), and the Dyson vacuum cleaner and Airblade hand dryer.

Quibi certainly had Hollywood budgets to produce premium content, but were their targets users (25-35 year old on-the-go mobile phone users) underserved? Or could they be swayed towards premium content at a premium price?

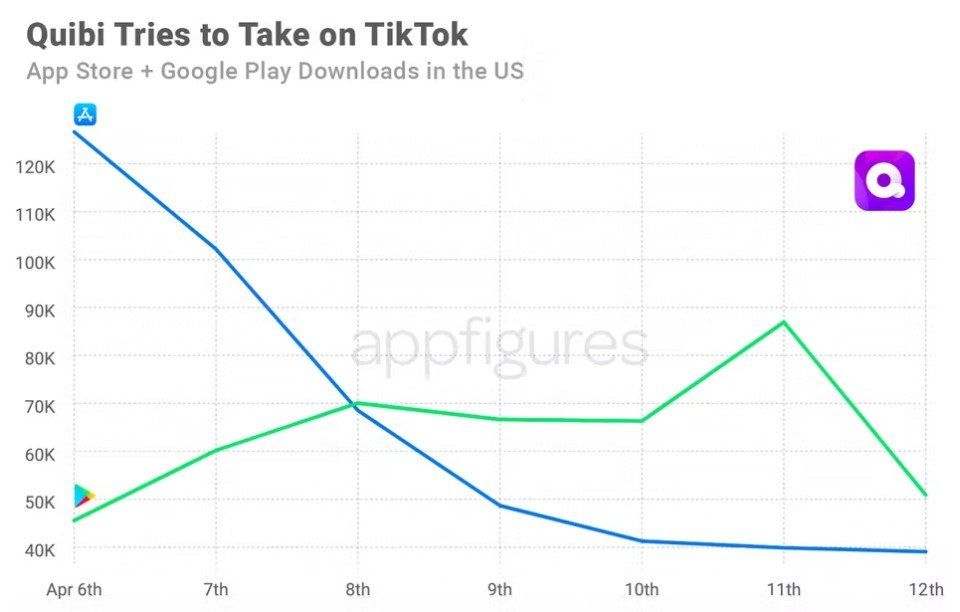

A Reverse Hockeystick!

Quibi launched in April 2020, with a 90-day free trial period for new users. Following the trial period, users were asked to pay $5 (with ads) or $8 (without ads) each month for the service. The former price puts it on a par with Apple TV Plus, and the latter makes it more expensive than Disney Plus – where users get access to a rich media library of well-known movies and shorts. In its first three months Quibi had 1.3M active users (compared to 3.5M downloads) versus Disney Plus's 41M installations in the same period. Some sources reported an 8% conversion rate post-trial (versus Disney Plus’s conversion rate of 11% on 9.5M new users who signed up in the first three days following its launch. That means that more than 90% of users who tried out the platform decided that Quibi wasn't worth paying for!

After the free trial launch period, there was no other way to ‘try before you buy’ with Quibi. A classic SaaS business without a way for users to test the product out for free? A bold move for a new concept. The product was also dependent on social proof to grow subscribers and revenues. A risky (and some might say naive) product-led growth strategy. Social sharing and word of mouth fuelled the explosion of Tiger King on Netflix in 2020 - if you hadn’t watched it you definitely felt FOMO. In contrast, the Quibi experience was solitary one in a hyper-connected world.

While other social platforms like YouTube, Instagram and TikTok aim to make the consumer feel closer to the creator, Quibi seemed to deliberately create an ‘us and them’ approach. For all its high-profile investors, there was a clear distinction between their role as a creator and ours as a consumer. For a company dependent on network effects and social proof to grow, they made it abundantly clear there was no role for co-creation or community in the user experience. Perhaps the sharp-suited-Hollywood-execs-turned-tech-founders were reluctant to let its old-Hollywood ivory tower crumble completely - just as the music industry did when they rallied against Napster?

While YouTube creators may spend between $500 and $5,000 per minute of video. Quibi, on the other hand, was spending $100,000 per minute ($6M per hour) for its top tier productions and engaging the likes of Stephen Spielberg and Reese Witherspoon as creators.

Who was going to pay?

The JTBD framework claims that a customer job does not change over time. Customers will likely be using different tools to get the job done at any point in time. What budget is already being spent on products hired to get the customer’s job done? Most of today’s content creators make their money as influencers – the consumer is not the payer and therefore is the ‘product’. In contrast, Quibi were planning to disrupt the market by charging users for premium content where those users were accustomed to consuming amateur content for free.

Perhaps one of the fatal flaws for Quibi was that there was simply no budget to take from?

“Quibi took everything that is Hollywood and nothing of what was truly a start-up, with its top-down model, OG [old guard] deals, dick swinging, and star f---ing,” says Evan Shapiro, who’s produced or created more than 150 shows, including one for Quibi—Let’s Go, Atsuko! “Take the worst parts of Hollywood, bake it into a phone, and that’s what you got.”

Network Effects & Community

Quibi made the unusual, and controversial, decision to disable users from sharing screenshots from their device – citing copyrighting concerns. A swift about-turn later, leadership admitted that they had misjudged the market and got to work on a product feature that would enable users to share.

Without a social sharing functionality – how was Quibi going to proliferate their content across millions of potential users? Without a break-out show that has social channels buzzing with content – Quibi would need to spend millions on advertising. In an effort to distance themselves from the competition they did not want to be associated with (i.e. social media and influencer platforms), Quibi also turned its back on how today’s user consumes media. Quibi were behaving like a premium brand – the Apple of streaming content, except that Apple TV already existed!

Quibi set itself up for failure by choosing to run a high-cost business model (premium content) that could not be solely dependent on advertising revenues (how many ads can you fit into a 10-minute segment before a user will disengage?), thereby needing to charge users AND advertisers. It also failed to consider its user in the original design, and enable influencers to engage on the platform – preferring instead to release numerous press releases that only served to confuse the media and led to less coverage overall.

Quibi pursued a product-led strategy without understanding how the flywheel works – they were neither better, nor easier to adopt, nor cheaper than the competition. Even if a user falls in love with this platform - how can they advocate for it? =

Quibi failed to acknowledge user needs, habits, expectations and norms

· Offering no personalisation of content – falling short of user expectations

· Offering no comment or discussion threads to feel part of something bigger

· Offering no social sharing or tribal connection

· Offering no way to co-create or feel part of the Quibi movement

There wasn't even a leader board of top shows to create social proof and induce FOMO 🤦♀️

There was simply no way for us to feel part of Quibi – in a world where we are all so connected – this shiny new platform felt old and stale.

R.I.P Quibi 🙏